Economy

16

Aug 12

Mitt’s 13% tax return piqued my interest…

So, Mitt Romney proudly announced today, after perusing his past tax records, that he’s never paid less than 13% for federal income taxes.

So, Mitt Romney proudly announced today, after perusing his past tax records, that he’s never paid less than 13% for federal income taxes.

After perusing my own past five years of tax records, I’ve never paid less than 18% for federal income taxes.

Granted, our incomes are are drastically different (it would take him a mere day and a half to make my and Shelley’s yearly income), but it raises questions about the conservatives’ penchant to gift the very rich with huge tax cuts. Or not.

Our federal income taxes are primarily a progressive tax system. In a progressive tax system, as one’s income increases they pay more taxes. The percentage is adjusted based on income; as income increases, the rate or tax bracket also increases. Our federal tax system does just that, up to a point. The tax rate actually begins to decrease for the very wealthy. The decrease is generally created by the breaks and incentives allowed by our congress for the wealthy.

Even so, the wealthy person ends up paying more for government services than I do. Part of me says it’s not fair to the wealthy. I use Interstate 5 often to get form point A to point B. If a wealthy person uses the same stretch of freeway, should he pay more than me? I don’t really have a good answer for that.

I also understand the theory behind trickle-down economics, which I believe is where all this leads. If we take care of the wealthy, the corporations, the employment sources… they’ll pass the good fortune down to the working class. Correct? I’m sure that there are corporations (they are people, right?), that actually do that. But I also believe that those honest corporations are in the minority, or trickle-down economics would work.

Sales tax is a regressive tax system. In a regressive tax system, everyone pays the same rate on items purchased. Regressive tax is not based on income, rather it’s based on the cost of goods.

The math. So, I go to the hardware store and buy a new handsaw for $24.99. I pay the 9.2% sales tax of $2.30 for a total of $27.29. Mitt Romney sees my new saw and wants one too. Same price, same tax, and same total. $2.30 sales tax is not a huge amount, but it’s a much larger percentage of my hourly wage than it is his. Even if I’m making a good wage of $30.00 an hour, $2.30 is 7.6% of that. Mitt Romney makes $10,384 an hour (based on what he reported as taxable income in 2010). $2.30 is 0.022% of his hourly income.

Bottom line: I paid 7.600% of my hourly income for sales tax. Mitt Romney paid 0.022% of his hourly income for sales tax.

With a regressive tax, the lower wage earners must pay a higher percentage of their incomes to pay the taxes on purchased goods and services.

Where am I headed with all this information? I have some real honest questions about the “best” route for our economy. Is it presumptuous of me to expect the wealthy to be saddled with more responsibility to society? What is most fair for all? I believe in our country and cherish the fact that people can be successful in their business ventures, but I often wonder if everyone truly has a equal opportunity to succeed? What can we do about greedy corporate giants who appear to care less about the less fortunate?

The issues are far broader than our federal income tax system. As I delve into the arguments, more and more questions without distinct answers appear. I certainly don’t have the answers, but searching for them will make me a more informed voter.

BTW, Mitt’s reported 2010 taxable income was $21.6 million. Simple math tells me that he paid $2.81 million in taxes.

22

Nov 11

Government Spending

By James Milstid

There is no question that The United States of America has the most powerful military in the world.

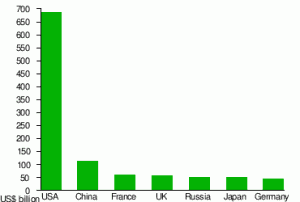

The chart to the left gives a pretty good picture of why that is. The U.S. military budget far and away exceeds any other single nation. Our warfare technology is beyond cutting edge and when used is dominating and frightening.

As the saying goes, “Freedom is not free.” I understand that and subscribe to it. In this uncertain time of world turmoil, a strong military defense is necessary for the preservation of the freedoms we enjoy.

But at what cost?

I certainly don’t have the answer to that, but comparing the world’s defense budgets begs an answer. Take a look at these numbers for the top seven world defense budgets compiled from various sources:

| Country | GDP | Mil. Budget | Population | Avg Salary | Defense Share |

|---|---|---|---|---|---|

| $15.1T | $698.1B | 312M | $49,445 | $2,141 | |

| $11.3T | $114.3B | 1,339M | $8,394 | $75 | |

| $2.2T | $61.3B | 65.8M | $26,416 | $977 | |

| $2.3T | $57.4B | 61.8M | $26,312 | $940 | |

| $2.4T | $52.6B | 142.9M | $9,945 | $430 | |

| $4.4T | $51.4B | 128M | $24,697 | $401 | |

| $3.1T | $46.8B | 81.8M | $25,146 | $558 |

In looking at the numbers, it appears that our country is spending over $2000 per capita on defense alone. That means that our freedom is costing $2000 a year for every man, woman, and child. And that’s only the defense budget. What about education, social security, healthcare, transportation, and a whole litany of other expenditures?

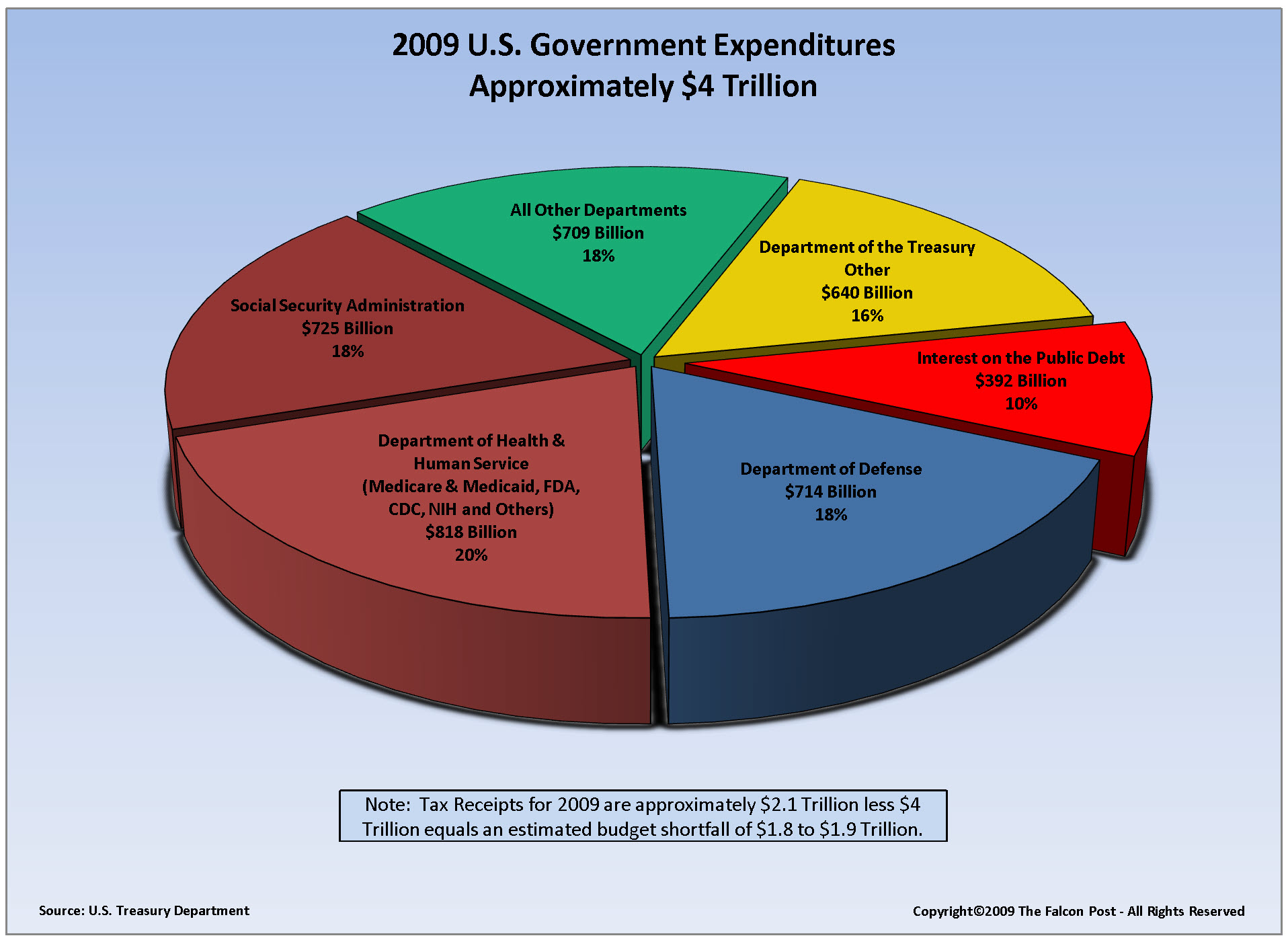

I Googled “US budget pie chart” and wasn’t at all surprised to find liberal and conservative versions of how our government spends money. My goal was to get a feel for how much every man, woman, and child is responsible for. It turned out to be very difficult to drill down to individual responsibilities. A very non-scientific bit of research resulted in anywhere from $5,000 to $10,000 per capita. That means that a family of four making $100,000 is out $20,000 to $40,000. I’ve never paid that much in taxes. I doubt that many middle-class families have.

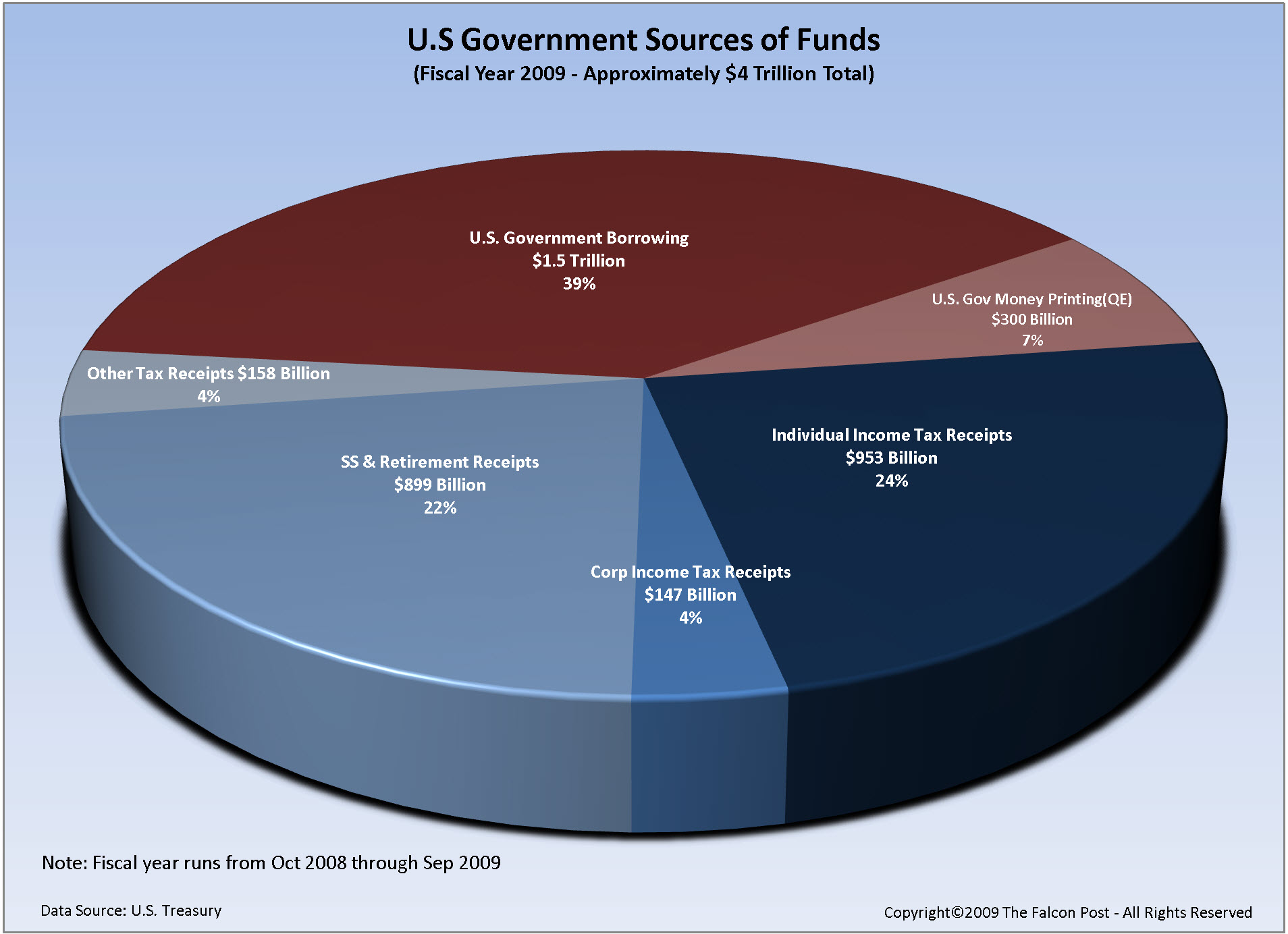

So where does the money to run our government come from? Best estimate says we need $4 trillion to keep our noses above water. A little napkin math tells me that it’s not coming from taxes alone.

Take a look at the following chart:

This chart was the most non-partisan indicator I could find. As I studied it, the first thing I saw was where a majority of our money comes from. A whopping 39%, $1.5 trillion is borrowed. Our income taxes amount to a little over half that, 24%, $953 billion. But hiding in the shadows is corporate taxes for a tiny 4%, $147 billion.

The next chart give a simplified idea of where the money goes.

…

Our elected legislators are consciously and knowingly trapped in a political quagmire, each faction insisting that their way is the only way out of the mess. In the meantime, we, as a nation, are sinking deeper and deeper into the sludge. Surely there have been reasonable solutions, but they would require compromise; something that is avoided at all cost in our politically-charged congress.

[To be continued…]

Sources:

12

Nov 11

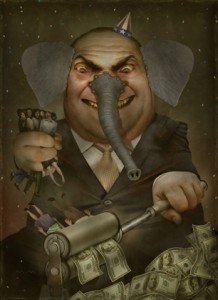

How the GOP Became the Party of the Rich

The inside story of how the Republicans abandoned the poor and the middle class to pursue their relentless agenda of tax cuts for the wealthiest one percent

The inside story of how the Republicans abandoned the poor and the middle class to pursue their relentless agenda of tax cuts for the wealthiest one percent

By: Tim Dickinson – Rolling Stone

The nation is still recovering from a crushing recession that sent unemployment hovering above nine percent for two straight years. The president, mindful of soaring deficits, is pushing bold action to shore up the nation’s balance sheet. Cloaking himself in the language of class warfare, he calls on a hostile Congress to end wasteful tax breaks for the rich. “We’re going to close the unproductive tax loopholes that allow some of the truly wealthy to avoid paying their fair share,” he thunders to a crowd in Georgia. Such tax loopholes, he adds, “sometimes made it possible for millionaires to pay nothing, while a bus driver was paying 10 percent of his salary – and that’s crazy.”

Preacherlike, the president draws the crowd into a call-and-response. “Do you think the millionaire ought to pay more in taxes than the bus driver,” he demands, “or less?”

The crowd, sounding every bit like the protesters from Occupy Wall Street, roars back: “MORE!”

The year was 1985. The president was Ronald Wilson Reagan.

Today’s Republican Party may revere Reagan as the patron saint of low taxation. But the party of Reagan – which understood that higher taxes on the rich are sometimes required to cure ruinous deficits – is dead and gone. Instead, the modern GOP has undergone a radical transformation, reorganizing itself around a grotesque proposition: that the wealthy should grow wealthier still, whatever the consequences for the rest of us.

Modern-day Republicans have become, quite simply, the Party of the One Percent – the Party of the Rich.

Read more: Rolling Stone: How the GOP Became the Party of the Rich

09

Nov 11

Old people getting richer, young people getting poorer

The age-based wealth gap is big and growing, thanks to younger Americans’ debts

The age-based wealth gap is big and growing, thanks to younger Americans’ debts

By Alex Pareene (A young writer at Salon)

Have you noticed how most of the Tea Party people were sort of old, while most of the Occupy Wall Street people are fairly young? Here’s an interesting factoid, from the USA Today: Old people are much, much richer than young people. According to the Pew Research Center, Americans 65 and older are 47 times richer than those 35 and younger.

It makes sense that old people would have more money than young people, because they have been working and saving longer. But this wealth gap is massive by historical standards. In 1984, old people were a mere 10 times richer than young people. Not only have old people gotten richer since then, but the median net worth of households headed by young people has declined considerably.

Households headed by adults ages 35 and younger had a median net worth of $3,662 in 2009. That marks a 68% decline in wealth, compared to that same age group 25 years earlier.

Over the same time frame, households headed by adults ages 65 years and older, have seen just the opposite. Their wealth rose 42%, to a median of $170,494.

It gets worse, for young people: “37% of the young households held zero or negative net worth in 2009, up from 19% in 1984.”

Boy, so what are all these old people complaining about, so much? (Immigrants, mostly.)

Continue reading →